Case for Benton County Tourism

WHO IS BENTON COUNTY TOURISM & RECREATION?

Benton County Tourism and Recreation is a 501c3 non-profit organization whose mission is to increase visitation and awareness of the Benton County Area. Our goal is to harness the county’s great tourism potential and transform it into an engine for growth and development that contributes to the goal of a prosperous economic future.

By utilizing the transient guest tax combined with corporate support for this continued economic growth, we develop an Annual County Tourism Plan. Additionally, the Plan focuses on highlighting our natural assets, our history and heritage, and the shopping and dining options in order to provide a rewarding and memorable experience to all visitors.

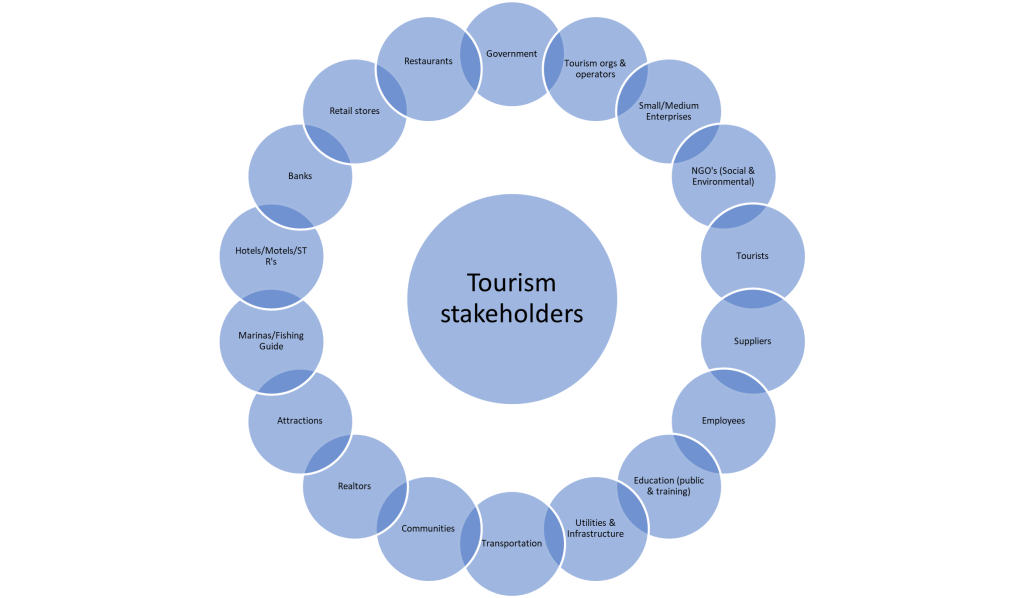

WHO ARE TOURISM’S STAKEHOLDERS?

Tourism has many stakeholders – being directly or indirectly associated to the outcomes produced from successfully marketing our destination. Such examples would be:

- Realtors

- Banks

- Retail businesses

- Transportation

- Outdoor recreation

- Restaurants

- Attractions

- Fishing guides

- Property Management: Airbnb, motels, hotels, long-term rentals

- Education

- Utilities and infrastructure

- Marinas

- Boat mechanics

- Storage facilities

- Charities and non-profit organizations

- Owners and employees of each of these businesses

To name a few.

WHY IS LOCAL TOURISM IMPORTANT?

Drawing visitors from far and wide has substantial benefits. When tourists travel to a community, they bring opportunities for local business owners and the hard-working individuals who hold the area together. Ultimately, tourism paves the way for positive change. Businesses and governments allocate resources to enhance the visitor experience while improving residents’ everyday lives.

Below are the statistics showing expenditures and tourism-related employment in Benton County, MO.

THE CASE FOR TOURISM

BENTON COUNTY TOTAL EXPENDITURES IN TOURISM-RELATED SIC CODES

FY23…………………………………….$27,187,365

FY22…………………………………….$24,447,361

FY21…………………………………….$22,274,404

FY20…………………………………….$18,626,626

FY19…………………………………….$18,246,504

FY18……………………………………..$17,944,722

Tourism spending is up 11.21% from 2022-2023.

TOURISM-RELATED EMPLOYMENT

2023 – 491

2022 – 475

2021 – 473

2020 – 447

2019 – 432

2018 – 420

BENTON COUNTY TOURISM FISCAL YEAR 2024 BUDGETED INCOME (estimated)

Transient Lodging Tax…………………………………….$80,000

Cities, Chambers and County Partners.…………. $55,250

Corporate Contributions…………………………………..$9,000

State of Missouri Marketing / Misc Grants..…….$36,000

Event Income (before expenses)……………………..$19,000

TOTAL FISCAL YEAR 2024 BUDGETED INCOME $199,250

The Fiscal 2024 BCTR Annual Budget expenditures are divided into four major categories. The budget is established annually by the BCTR Board of Directors, which is proposed by the Executive Director.

The major expenditures in marketing include major Missouri magazines and print publications, website and online presence, special events and festivals, marketing strategy including search engine optimization and search engine marketing, exhibiting at travel shows, billboards, collateral for shows, mailings to Missouri Welcome Centers, marketing videos and photography, county-wide event cards, radio advertising, a digital billboard in Sedalia, and memberships in tourism-related organizations for networking and promotional purposes. Administration includes everyday responsibilities of insurance, contractor salary and D&O insurance, as well as phones, internet, mileage, checks and tax preparation. The Executive Director is a contractor who pays her own insurance and taxes and does not receive paid vacation or sick days.

BCTR FISCAL YEAR 2024 BUDGETED EXPENSES (estimated)

Advertising/Events/Mktg………………………………….$109,625

Administration……………………………………………….….$87,876

Professional Memberships/Services……………………….$625

General Reserve…………………………………………………..$1,124

TOTAL FISCAL YEAR 2024 BUDGETED EXPENSES $198,126

Furthermore, we work in conjunction with the cities of Cole Camp, Lincoln and Warsaw, as well as the three Chambers of Commerce for each town to promote attractions, shopping, events and dining to tourists and future residents within our county. Likewise, we know that tourism plays a large role in the economic development of our county.

BCTR is able to continue to increase our marketing efforts due to the support of organizations, corporate contributions and individuals who believe in the promotion of tourism and economic development in Benton County. We believe our marketing plan for 2024 is both comprehensive and effective and will reach a larger group of potential tourists.

The city of Lincoln’s sales tax went up 7%, the City of Cole Camp’s sales tax is up 8% and Warsaw’s sales tax stayed the same from 2022 to 2023.

Tourism Development is the key to our economic future for the reasons listed above.

SUMMARY

One of the many primary benefits of local and community-based tourism is the positive impact on local economies. By promoting small-scale tourism and working with local businesses, tourism can create jobs and generate income for the community. This economic benefit can help improve the standard of living for local residents and provide long-term economic sustainability.

TOGETHER WE CAN DO MORE!

Benton County Tourism & Recreation

PO Box 1245

Warsaw MO 65355

www.visitbentoncomo.com

Phone: (660) 438-2090

Email: lstokes@visitbentoncomo.com

BENTON COUNTY TOURISM FISCAL YEAR 2022 ACTUAL INCOME

Transient Lodging Tax…………………………….……….$75,000

Cities, Chambers and County Partners.….………. $55,750

Corporate Contributions………………………….…….. $10,000

State of Missouri Marketing / Misc Grants…..…..$62,700

Event Income (before expenses)………………….…..$15,420

TOTAL FISCAL YEAR 2022 BUDGETED INCOME $218,870

The Fiscal 2022 BCTR Annual Budget expenditures are divided into five major categories. The budget is established annually by the BCTR Board of Directors, which is proposed by the Executive Director.

Please review our 2022 Marketing Plan for detailed information on how we are spending our funding.

BCTR FISCAL YEAR 2022 ACTUAL EXPENSES

Advertising/Events/Mktg……………………………………..$157,220

Equipment/Assets…………………………………………………..$1,500

Administration………………………………………………..…….$80,085

Professional Memberships/Services…………………..……..$620

General Reserve………………………………………………….…………$0

TOTAL FISCAL YEAR 2022 BUDGETED EXPENSES $239,425

BCTR Lodging Tax Actual income and expenses – 2021

BENTON COUNTY TOURISM FISCAL YEAR 2021 ACTUAL INCOME

Transient Lodging Tax…………………………….……….$67,289

Cities, Chambers and County Partners.….………. $47,500

Corporate Contributions………………………….………$10,000

State of Missouri Marketing / Misc Grants…..…..$20,734

Event Income (before expenses)………………….…..$20,285

TOTAL FISCAL YEAR 2021 ACTUAL INCOME $165,808

BCTR FISCAL YEAR 2021 ACTUAL EXPENSES

Advertising/Mktg/Events……………………………………$103,175

Administration………………………………………………..…..$56,011

Equipment/Assets……………………………………………………$510

Professional Memberships/Services…………………..……$525

Housing Study………………………………………………….….$11,000

TOTAL FISCAL YEAR 2021 ACTUALEXPENSES $171,221

2020 Benton County Tourism Income & Expenses

BENTON COUNTY TOURISM FISCAL YEAR 2020 ACTUAL INCOME

Transient Lodging Tax…………………………………….$65,665

Cities and County Partners……………………………. $37,041

Corporate Contributions…………………………………$15,351

State of Missouri Marketing Grants………………..$38,964

Event Income (before expenses)……………………….$2,430

Housing study grant………………………………………..$22,000

TOTAL FISCAL YEAR 2020 ACTUAL INCOME $181,451

BCTR FISCAL YEAR 2020 ACTUAL EXPENSES

Advertising/Events/Mktg…………………….……….……..$76,797

Administration…………………………………….……………..$51,870

Professional Memberships/Services…………….…………$765

BCTR Grant…………………………………………………………..$3,450

Housing study grant……………………………………..…….$11,000

Reserved for 2021…………………………………………………$5,798

General Reserve………………………………………………….$31,771

TOTAL FISCAL YEAR 2020 ACTUALEXPENSES $181,451

2019 Benton County Tourism Income & Expenses

BENTON COUNTY TOURISM FISCAL YEAR 2019 ACTUAL INCOME

Transient Lodging Tax……………………………….…….$53,765

Cities and County Partners……………………….……. $35,518

Corporate Contributions………………………….………$10,937

State of Missouri Marketing Grants………….……..$ 4,599

Event Income (before expenses)…………….……….$ 5,871

TOTAL FISCAL YEAR 2019 ACTUAL INCOME $110,690

BCTR FISCAL YEAR 2019 ACTUAL EXPENSES

Advertising/Events/Mktg……………………………..……..$46,139

Administration………………………………………….………..$46,025

Professional Memberships/Services………….…………$1,295

BCTR Grant…………………………………………………………..$4,664

General Reserve………………………………………………….$12,567

TOTAL FISCAL YEAR 2019 ACTUAL EXPENSES $110,690

2018 Benton County Tourism Income & Expenses

BENTON COUNTY TOURISM FISCAL YEAR 2018 ACTUAL INCOME

Transient Lodging Tax………………………………………$55,308

Cities and County Partners……………………………….$27,200

Corporate Contributions………………………………..…$15,019

State of Missouri Marketing Grants………….………$ 1009

Event Income (before expenses)………………….…..$ 8,337

TOTAL FISCAL YEAR 2018 ACTUAL INCOME $106,873

BCTR FISCAL YEAR 2018 ACTUAL EXPENSES

Advertising/Events/Mktg……………………….……………$46,942

Administration……………………………………….…………..$40,426

Professional Memberships/Services…………………….…$522

BCTR Grant…………………………………………………………..$3,760

General Reserve………………………………………………….$15,223

TOTAL FISCAL YEAR 2018 ACTUAL EXPENSES $106,873